CPEC PROJECTS: DETAIL COST STATUS AND BENEFITS

The usage of the vitality and foundation ventures recognized under the China-Pakistan Economic Corridor is being done on a most optimized plan of attack premise on the two sides to make an interpretation of the plans into the real world.

The Silk Road Fund Co. Ltd was built up in China last December to stretch out venture and financing backing to CPEC ventures and to advance mechanical collaboration with Pakistan.

The store the board organization — set up as a consortium of driving Chinese banks, including the China Exim Bank and the China Development Bank — had starting assets of $10bn, which have now been raised to $40bn.

Peruse: Pakistan will proceed with usage of CPEC venture: FO

The spearheading undertaking to be actualized under the program is the 720MW Karot hydropower venture, for which $1.65bn has been reserved by the Silk Road Fund, and the up front installment is under delivery.

The Fund has just marked a MoU with China's Three Gorges Corporation and the Private Power and Infrastructure Board (PPIB) to build up various private hydropower ventures, including Karot, which was endorsed a month ago by the PPIB's governing body. The PPIB has just given the letter of help (LoS), and land obtaining is in measure.

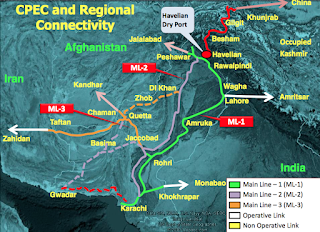

The driven CPEC program has two fundamental segments. It intends to build up another exchange and transport course from Kashgar in China to the Gwadar Port. The other segment visualizes creating unique monetary zones along the course, including power ventures. The main stage tasks will get $45.69bn in concessionary and business credits, for which budgetary help to the Chinese organizations is being masterminded by the Silk Road Fund.

These incorporate $33.79bn for vitality ventures, $5.9bn for streets, $3.69bn for railroad organization, $1.6bn for Lahore Mass Transit, $66m for Gwadar Port and a fiber optic undertaking worth $4m.

The organized, momentary tasks include over $17bn in venture. Aside from Karot, they incorporate the updating of the 1,681km Peshawar-Lahore-Karachi railroad line ($3.7bn); Thar coal-terminated force plants worth 1,980MW ($2.8bn); advancement of two Thar coal mining blocks ($2.2bn); the Gwadar-Nawabshah gaseous petrol pipeline ($2bn); imported coal-based force plants at Port Qasim worth 1,320MW ($2bn); a sunlight based park in Bahawalpur worth 900MW ($1.3bn); the Havelian-Islamabad connection of the Karakoram Highway ($930m); a breeze ranch at Jhimpir for 260MW ($260m); and the Gwadar International Airport ($230m).

The Sindh Engro Coal Mining Company, a joint endeavor of Engro Powergen Ltd and the Sindh government, holds the rent of Thar Block-II coalfields, while it's Thar Power Company will build a progression of mine-mouth power plants.

Given the course of events for fruition, these force ventures might include sensible age limit by 2017-18, yet they would scarcely give any help to the country regarding the quickly developing interest for power

In May, the PPIB closed the usage and the force buy arrangements for two 330MW activities, which are booked to start business tasks by December 2017. Furthermore, the China Development Bank has settled the terms and conditions for financing a 3.8m tons for every annum coal-mining venture just as a force venture.

On June 25, the PPIB affirmed another Thar coal-based mine-mouth power task of 1,320MW limit, which is being created by the Shanghai Electric (Group) Corporation in association with Sino-Sindh Resources, an auxiliary of Global Mining (China) Ltd.

Sino-Sindh Resources will get $1bn from the Industrial and Commercial Bank of China. The mine-mouth power venture, initially intended to begin power age in 2016, has been rescheduled for appointing by 2017-18. A letter of enthusiasm from the Chinese banks was given in March for 75pc financing of the $2.6bn venture, 25pc of which will be value.

Likewise, Chinese banks will give financing to two 660MW imported coal-terminated force plants at Port Qasim.

A financing participation arrangement was as of late marked by the China Exim Bank and the Port Qasim Electric Power Company for the under-development venture. The National Electric Power Regulatory Authority endorsed the forthright duty on February 13.

The other 660MW task at Port Qasim is being created by the Lucky Electric Power Company. The two ventures are planned to start business tasks inside four years. In any case, they are probably going to be postponed as a devoted wharf for each venture must be built for emptying the imported coal, and the agreements for them have not yet been granted.

In the interim, the Punjab government has rented 4,500 sections of land of land to Chinese speculators for the advancement of the second period of the Quaid-e-Azam Solar Park of 900MW, to be dispatched in 21 months. The China Development Bank, Exim Bank of China and Zonergy Co Ltd will be engaged with it.

In like manner, the draw-down understanding for the Jhimpir wind venture between UEP Wind Power (the borrower) and the China Development Bank Corporation (the moneylender) has been closed. The venture, having accomplished money related close, is planned to start business tasks in 2016.

Given the timetable for finish, these force tasks might add sensible age ability to the public framework by 2017-18, however they would scarcely give any help to the country regarding the quickly developing interest for power. Furthermore, there is no silver covering for buyers to the extent the expense of the power is concerned.

All the Chinese advances will be protected by the China Export and Credit Insurance Corporation (Sinosure) against non-installment hazards, and the security of the advances is ensured by the state.

A system arrangement for vitality extends under CPEC was as of late marked among Sinosure and the water and force service to give sovereign assurances.

Sinosure is charging an expense of 7pc for obligation overhauling, which will be added to the capital expense of a venture. For example, the capital expense of a 660MW undertaking at Port Qasim is $767.9m. However, it goes up to $956.1m by including Sinosure's expense of $63.9m, its financing expense and charges of $21m, and enthusiasm during development of $72.8m; a 27.2pc profit for value is ensured.

Unexpectedly, enthusiasm during development is permitted at the pace of 33.33pc for the main year; 33.33pc for the second; 13.33pc for the third; and 20pc for the fourth year. The situation presents a distressing picture, as the accessibility of moderate vitality will probably stay a pipedream.

The essayist is a resigned director of the State Engineering Corporation, Ministry of Industries and Production.

0 Comments